| Episode 9149 GUESTS/AFFILIATIONS: Joshia Ramo///Diana Krall, Singer///Stephan Paternot, Co-CEO, The Globe.Com; Todd Krizelman, Co-CEO, The Globe.Com | |

Online Forex Trading at Marketiva, Trading Forex (Valas) di Marketiva. Mudah, Murah, Simple, dan Menjanjikan

Tuesday, December 26, 2006

Charlie Rose - GREENSPAN EFFECT/KRALL/THE GLOBE

Saturday, December 02, 2006

Tanya Jawab dengan Team Support Marketiva

Calon Klien: Bagaimana sih cara memulai trading di sini?

Calon Klien: Setelah itu bagaimana?

Calon Klien: Boleh nggak saya coba account virtualnya dulu?

Calon Klien: Selain itu, apa strategi yang bisa saya gunakan?

Calon Klien: Apa saja analisis teknikal yang bisa saya gunakan?

Calon Klien: Ngomong-ngomong kantor pusat Marketiva dimana sih?

Calon Klien: Satu lagi.... berapa lama saya bisa menahan posisi yang telah saya buka?

Calon Klien: Margin Call? bagaimana cara kerjanya?

Calon Klien: saya udah selesai bikin account nih, bisa login pakai streamster sekarang?

Team Support: Bisa pak :-)

Saya: Hallo saya udah login nih.

Saya: Okie... saya mo trading aja dulu.. nanti saya tanya lagi di international support deh.

Saya: Long sama Short itu apa ya?

Saya: Ini ada juga Limit/Stop, fungsinya untuk apa?

Saya: Kalo Target sama Stop-L?

Saya: ooo... begitu ya. Kalau full sama partial ini untuk apa ya?

Saya: Kalau mo tambah modal gimana?

Saya: Oke deh.. kayaknya segitu aja dulu, saya mo latihan trading dulu nih. Makasih banyak ya.. semoga sukses!

Demikianlah hasil chating saya dengan salah seorang team support Marketiva yang bisa bahasa Indonesia.

Tuesday, November 07, 2006

BELAJAR DAN BERMAIN FOREX

BELAJAR DAN ERMAIN FOREX (SIMPLE, MUDAH DAN MENJANJIKAN)

Bagi anda yang ingin Mendapatkan Pendapatan Yang bisa dibilang tidak disedikit ini adalah cara yang termudah dengan meluangkan waktu sedikit di internet untuk bisa mewujudkannya. Pada kali ini saya akan menjelaskan bagaimana kita bermain Forex, dan Apa itu Forex serta bagaimana kita bisa menajdi untuk dengan bermain Forex.

FOREX TRADING (valas trading) merupakan pasar terbesar di dunia diukur berdasarkan nilai total transaksi. Menurut survei BIS (Bank International for Settlement-bank sentralnya bank-bank sentral seluruh dunia), yang dilakukan pada akhir tahun 2004, nilai transaksi forex mencapai USD 1,900 miliar per hari. Dengan demikian, prospek investasi di perdagangan forex adalah sangat bagus.

Pasar valas/forex berjalan selama 24 jam, berputar mulai dari pasar New Zaeland & Australia yang berlangsung pukul 05.00-14.00 WIB, terus ke pasar Asia yaitu Jepang & Singapura yang berlangsung pukul 07.00-16.00 WIB, ke pasar Eropa yaitu Jerman & Inggris yang berlangsung pukul 13.00-22.00, sampai ke pasar Amerika yang berlangsung pukul 20.30-10.30. Dalam perkembangan sejarahnya, bank sentral milik negara-negara dengan cadangan mata uang asing yang besar sekalipun dapat dikalahkan oleh kekuatan pasar forex/valas yang bebas.

Forex trading (valas trading) saat ini sudah sangat mudah untuk dilakukan oleh siapapun dan dari manapun. Dengan modal komputer yang tersambung ke internet, kita sudah bisa melakukan forex trading (valas trading) baik dari rumah, kantor, warnet, dan darimana saja yang penting ada fasilitas sambungan internet. Dengan mendaftar di Marketiva, Anda tidak perlu lagi memikirkan modal untuk melakukan forex trading (valas trading), begitu daftar langsung bisa trading karena Anda mendapatkan cash reward $5 real money untuk live trading dan $10,000 virtual money untuk simulasi dengan kondisi pasar yang sesungguhnya (demo). Belajar forex trading (valas trading) dengan metoda belajar sambil praktek akan membuat Anda lebih cepat memahami segala hal tentang forex trading (valas trading).

Transaksi real maupun belajar Forex Trading (valas trading) di Marketiva adalah pilihan terbaik bagi para calon trader dalam mengembangkan ilmu, maupun bagi trader profesional dalam bertransaksi forex trading (valas trading).

KEUNGGULAN

Marketiva provides spot forex on major currency pairs and crosses; $5 cash reward you can start trading right away; tight spreads from 3 pips; trading on 1% margin; virtual and live desks within one account; latest news, alerts on market events, signals, no market commissions; zero-interest on open positions, 24-hour support, chat channels, the most sophisticated and easy-to-use forex charting tool; ability to trade from the charts and the best forex trading software available!

Untuk bisa memulai transaksi sekaligus belajar forex trading (valas trading) di Marketiva, ikutilah langkah-langkah berikut secara berurutan.

MENDAFTAR

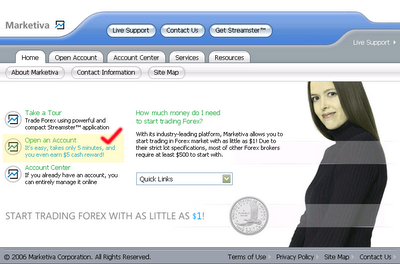

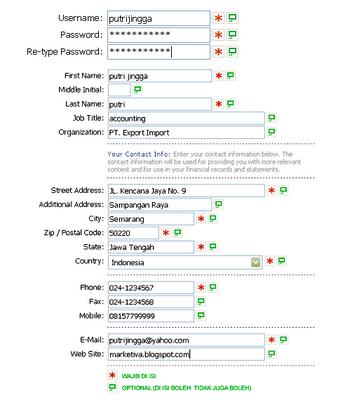

Untuk mendaftar, silakan buka website Marketiva, setelah terbuka, klik Open Account, isilah data diri Anda secara lengkap. Untuk field dengan tanda * (bintang) harus Anda isi, yang lain boleh Anda kosongkan.

Username: pilihlah username yang indah, karena akan Anda gunakan untuk chatting dengan sesama trader, misalnya: cinta, cantik, handsome, dsb.

Password: minimal 8 karakter gabungan huruf dan angka.

First Name: isi nama depan Anda

Last Name: isi nama belakang Anda, jika nama Anda hanya terdiri dari satu suku kata, masukkan nama Anda tersebut di field First Name dan Last Name. Contoh: jika nama Anda adalah Fitri, maka masukkan First Name: Fitri, Last Name: Fitri.

Untuk data alamat isikan sesuai dengan KTP Anda.

E-mail: diisi alamat e-mail Anda yang masih aktif.

PERHATIAN: Seluruh data diri yang Anda isikan harus sama dengan KTP, karena akan dilakukan proses verifikasi untuk bisa melakukan transaksi forex trading (trading valas).

Setelah selesai mengisi, klik tombol Continue >>

Setelah selesai mengisi, klik tombol Continue >>

User Template: pilih Standar Forex Trader

Coupon: boleh dikosongkan

Recovery Question: pilih yang paling cocok dengan Anda, misalnya Anda memiliki kucing dengan nama manis, maka pilih: What is your pet’s name?

Recovery Answer: dalam contoh ini maka jawaban anda adalah: manis

Setelah selesai mengisi, klik tombol next >>

Berilah tanda chek pada pilihan: I have read, understood, and agree with the Service Agreement under which Marketiva Corporation provides it services and products. I have also read and understood the Risk Disclosure statement and I am willing and able to assume such risks.

Setelah itu klik tombol [finish]. Maka proses pendaftaran Anda sudah selesai.

VERIFIKASI IDENTITAS DIRI

Setelah Anda mendaftar, maka Anda perlu mengupload data diri Anda untuk diverifikasi, Anda hanya diizinkan membuka satu account. Anda tidak bisa melakukan penarikan dana sebelum melakukan identifikasi, dan ada kemungkinan account Anda di-suspend (dibekukan) jika Anda menggunakan komputer dengan IP address yang sama dengan trader lain. Untuk itu segeralah melakukan verifikasi identitas diri, berikut data yang diperlukan:

Image ID: Scan KTP/SIM/KTM atau kartu identitas lain yang ada foto dan nama Anda tertera di kartu identitas tersebut.

Image Adress: Scan data tagihan yang alamatnya sama dengan KTP/SIM/KTM Anda, misal tagihan listrik, tagihan telepon, rekening bank dll, data di tagihan ini digunakan untuk konfirmasi alamat.

Scan data harus berwarna dan masing-masing file ukurannya maksimal 100kb, jadi sewaktu scan, resolusi di set ke 72-100 dpi saja.

Bila Anda tidak mempunya data tagihan yang ada nama dan alamat Anda disitu, maka anda boleh mengupload scan ktp saja, scan bagian depan KTP sebagai ID image, bagian belakang sebagai Address image.

Upload scan data tersebut di sini

Setelah mengupload data, melaporlah ke live support yang ada di situs Marketiva. Beberapa saat kemudin Anda akan diberitahu bahwa data diri Anda telah selesai diverifikasi.

MEMBUKA ACCOUNT E-GOLD

Proses deposit dan withdrawl termudah adalah dengan e-gold, silakan Anda baca secara lengkap tata cara membuka e-gold, klik disini. PASTIKAN: Nama lengkap Anda di account e-gold harus sama dengan nama lengkap di Marketiva, jika tidak sama maka Anda akan mengalami kesulitan dalam proses deposit dan withdrawl.

Saturday, October 07, 2006

Pivot Point Trading

The pivot point is the level at which the market direction changes for the day. Using some simple arithmetic and the previous days high, low and close, a series of points are derived. These points can be critical support and resistance levels.

The pivot level and levels calculated from that are collectively known as pivot levels.

Every day the market you are following has an open, high, low and a close for the day (some markets like forex are 24 hours but generally use 5pm EST as the open and close). This information basically contains all the data you need to calculate the pivot levels.

The reason pivot points are so popular is that they are predictive as opposed to lagging. You use the information of the previous day to calculate potential turning points for the day you are about to trade (present day).

Because so many traders follow pivot points you will often find that the market reacts at these levels. This give you an opportunity to trade.

Before I go into how you calculate pivot points, I just want to point out that I have put an online calculator and a really neat desktop version that you can download for free HERE

If you would rather work the pivot points out by yourself, the formula I use is below:

Resistance 3 = High + 2*(Pivot - Low)

Resistance 2 = Pivot + (R1 - S1)

Resistance 1 = 2 * Pivot - Low

Pivot Point = ( High + Close + Low )/3

Support 1 = 2 * Pivot - High

Support 2 = Pivot - (R1 - S1)

Support 3 = Low - 2*(High - Pivot)

As you can see from the above formula, just by having the previous days high, low and close you eventually finish up with 7 points, 3 resistance levels, 3 support levels and the actual pivot point.

If the market opens above the pivot point then the bias for the day is for long trades as long as price remains above the pivot point. If the market opens below the pivot point then the bias for the day is for short trades as long as the market remains below the pivot point.

The three most important pivot points are R1, S1 and the actual pivot point.

The general idea behind trading pivot points is to look for a reversal or break of R1 or S1. By the time the market reaches R2,R3 or S2,S3 the market will already be overbought or oversold and these levels should be used for exits rather than entries.

A perfect set up would be for the market to open above the pivot level and then stall slightly at R1 then go on to R2. You would enter on a break of R1 with a target of R2 and if the market was really strong close half at R2 and target R3 with the remainder of your position.

Unfortunately life is not that simple and we have to deal with each trading day the best way we can. I have picked a day at random from last week and what follows are some ideas on how you could have traded that day using pivot points.

On the 12th August 04 the Euro/Dollar (EUR/USD) had the following:

High - 1.2297

Low - 1.2213

Close - 1.2249

This gave us:

Resistance 3 = 1.2377

Resistance 2 = 1.2337

Resistance 1 = 1.2293

Pivot Point = 1.2253

Support 1 = 1.2209

Support 2 = 1.2169

Support 3 = 1.2125

Have a look at the 5 minute chart below

Have a look at the 5 minute chart below

The green line is the pivot point. The blue lines are resistance levels R1,R2 and R3. The red lines are support levels S1,S2 and S3.

There are loads of ways to trade this day using pivot points but I shall walk you through a few of them and discuss why some are good in certain situations and why some are bad.

The Breakout Trade

The Pullback Trade

Advanced

In the example below the market passed through S1 and then retraced to the S1 line again. It then formed a channel. At around this time we had a cross of the averages, MACD signaled buy and there was a breakout of the channel line. This gave a great signal to go long with a target of the original pivot line.

Mess around with a few of your favorite indicators to help determine an entry around a pivot level but remember the signal is a break of a level and the indicators are just confirmation.

We haven't even got into patterns around pivot levels or failures but that is not the point of this lesson. I just want to introduce another possible way for you to trade.

Good Trading

Mark McRae

Information, charts or examples contained in this lesson are for illustration and educational purposes only. It should not be considered as advice or a recommendation to buy or sell any security or financial instrument. We do not and cannot offer investment advice. For further information please read our disclaimer.

Monday, September 25, 2006

Forex vs Other Investment Programs

Artikel ini ada untuk menjawab pertanyaan diatas. Berikut beberapa kelebihan yang ditawarkan forex trading yang tidak dapat ditawarkan investasi lainnya:

- Return on Investment tertinggi dibanding investasi lainnya. Adakah investasi yang sanggup menawarkan return hingga tak terbatas? Forex dapat melakukannya!

- Likuiditas yang tinggi. Ini berarti Anda selalu dapat membeli atau menjual mata uang yang hendak Anda transaksikan dan tidak ada istilah gagal serah disini. Ketika Anda melakukan aksi beli, selalu ada pihak lain yang akan menjualnya kepada Anda dan sebaliknya. Ini terjadi karena memang lingkup investasi forex adalah bursa dunia yang saling terhubung satu sama lain. Berbeda dengan bursa lokal (ex: BEJ) dimana transaksi hanya berlangsung pada bursa tersebut saja sehingga dapat terjadi peristiwa gagal serah.

- Modal yang dibutuhkan relatif kecil. Memang dahulu modal yang dibutuhkan bisa sangat besar (mencapai 100 Juta). Tapi kini dengan AsiaFxOnline dari PT AKKB, modal yang dibutuhkan hanya Rp 5 juta saja. Kalau di Marketiva anda tidak perlu menyetorkan sejumlah uang untuk mulai trading forex, cukup isi form registrasi maka anda akan dapat modal $5 real dan $10000 virtual. Bandingkan dengan investasi lain misalnya saham yang membutuhkan modal setidaknya Rp 20 Juta atau investasi sektor riil yang biasanya lebih dari Rp 50 Juta.

- Jam trading 24 jam sehari dan 5 hari seminggu. Tidak ada kata malam atau siang hari dalam dunia forex trading. Pasar berlangsung selama 24 jam sehari dimulai dari pasar Asia hingga pasar Eropa dan Amerika. Bandingkan dengan Saham yang hanya buka pada office hours atau pasar komoditi yang hanya buka pagi hingga siang hari. Jika Anda seorang pekerja kantoran, Anda dapat bertransaksi forex trading pada malam hari dan tidak mengganggu jam kerja Anda.

- Dimana saja, kapan saja dan siapa saja bisa bergabung. Betul, investasi tidak mengenal kasta. Begitu juga dengan forex trading. Siapa pun Anda, pedagang, pekerja, seorang ibu rumah tangga atau bahkan seorang petani sekali pun dapat bergabung. Dan lebih hebatnya lagi dengan kemajuan dunia internet, Anda dapat bertrading dimana saja tanpa harus pergi ke bursa yang bersangkutan atau menelepon dealer Anda secara langsung. Ini jelas menghemat waktu dan biaya Anda!

- Investor bertindak aktif dalam investasinya. Tidak seperti investasi lain dimana investor hanya dapat mempercayakan dananya dikelola pihak ketiga (reksadana, asuransi, deposito, dsb), pada forex trading Andalah yang menentukan sendiri kapan dan seberapa besar Anda hendak berinvestasi dengan melakukan aksi beli atau jual. Kini investasi Anda bergantung pada diri Anda sendiri dan tidak kepada orang lain.

- Harga real time yang dapat Anda akses setiap saat secara cuma-cuma. Kami rasa ini sudah cukup, tidak perlu dijelaskan kembali. Semuanya gratis.

- Tersedia demo account yang dapat Anda miliki secara gratis tanpa membayar sepesr pun! Jika Anda orang baru dalam dunia forex, ini akan sangat membantu Anda karena harga yang tertera pada demo account adalah sama dengan harga yang sesungguhnya terjadi di pasar.

- Leverage yang ditawarkan 1:100. Ini artinya dengan satu bagian yang Anda keluarkan, Anda dapat membeli atau menjual sebanyak 100 bagian. Inilah kelebihan dari margin trading dimana yang dibutuhkan hanyalah jaminan saja untuk membeli atau menjual barang yang dibutuhkan. Pada forex trading ini diimplementasikan dengan modal sebesar 1 Juta Rupiah ($100) maka Anda dapat membeli Dollar sebanyak $10.000 dan juga sebaliknya untuk aksi jualnya. Itulah sebabnya margin yang dibutuhkan per lotnya pada AsiaFxOnline dipatok Rp 1 Juta.

- Online reporting and transaction. Memang dahulu forex trading dilakukan melalui telepon dan laporan tertulis hasil transaksi Anda akan dikirim melalui email atau bahkan pos setiap bulannya. Tetapi kini dengan akses internet, bahkan laporan transaksi Anda pun dapat Anda akses kapan pun Anda mau tanpa harus menunggu dari pihak pialang melaporkannya kepada Anda.

- Keamanan dan kerahasiaan terjamin. Meskipun transaksi dilakukan melalui internet bukan berarti kemanan dan kerahasiaan informasi serta dana Anda tidak dijamin. Pihak pialang menyediakan enskripsi data yang ditransaksikan dan dana Anda pun aman tersimpan pada segregated account apabila Anda melakukannya pada pialang yang legal.

Tuesday, September 19, 2006

Marketiva Online Forex Trading

Marketiva is a market maker for instruments traded on the over-the-counter foreign exchange (forex) markets. Through Marketiva, you can buy or sell instruments like EUR/USD, GBP/JPY and others. Marketiva also provides services like discussion channels, latest forex news, trading signals and alerts, charting services and many more.

Marketiva provides spot forex on major currency pairs and crosses; $5 cash reward you can start trading right away; tight spreads from 3 pips; trading on 1% margin; virtual and live desks within one account; latest news, alerts on market events, signals, no market commissions; zero-interest on open positions, 24-hour support, chat channels, the most sophisticated and easy-to-use forex charting tool; ability to trade from the charts and the best forex trading software available!

It is free, and get $5 cash reward you can start trading right away!

Forex Market

The Foreign Exchange market, also referred to as the "Forex" or "FX" market, is the largest financial market in the world, with a daily average turnover of approximately US$1.5 trillion. In comparison, the daily volume of the New York Stock Exchange is approximately US$30 billion per day.

Until now, professional traders from major international commercial and investment banks have dominated the FX market. Other market participants range from large multinational corporations, global money managers, registered dealers, international money brokers, and futures and options traders, to private speculators.

There are three main reasons to participate in the FX market. One is to facilitate an actual transaction, whereby international corporations convert profits made in foreign currencies into their domestic currency. Corporate treasurers and money managers also enter the FX market in order to hedge against unwanted exposure to future price movements in the currency market. The third and more popular reason is speculation for profit. In fact, today it is estimated that less than 5% of all trading on the FX market is actually facilitating a true commercial transaction.

How It Works

Foreign Exchange is the simultaneous buying of one currency and selling of another. The world's currencies are on a floating exchange rate and are always traded in pairs, for example Euro/Dollar or Dollar/Yen. In trading parlance, a long position is one in which a trader buys a currency at one price and aims to sell it later at a higher price. A short position is one in which the trader sells a currency in anticipation that it will depreciate. In every open position, an investor is long in one currency and shorts the other. FX traders express a position in terms of the first currency in the pair. For example, someone who has bought dollars and sold yen (USD/JPY) at 104.37 is considered to be long US Dollars and short Yen.

The most often traded or 'liquid' currencies are those of countries with stable governments, respected central banks, and low inflation. Today, over 85% of all daily transactions involve trading of the major currencies, including the US Dollar, Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar and Australian Dollar.

The FX market is considered an Over The Counter (OTC) or 'Interbank' market, due to the fact that transactions are conducted between two counterparts over the telephone or via an electronic network. Trading is not centralized on an exchange, as with the stock and futures markets. A true 24-hour market, Forex trading begins each day in Sydney, and moves around the globe as the business day begins in each financial center, first to Tokyo, London, and New York. Unlike any other financial market, investors can respond to currency fluctuations caused by economic, social and political events at the time they occur - day or night.

Factors Affecting the Market

Currency prices are affected by a variety of economic and political conditions, most importantly interest rates, inflation and political stability. Moreover, governments sometimes participate in the Forex market to influence the value of their currencies, either by flooding the market with their domestic currency in an attempt to lower the price, or conversely buying in order to raise the price. This is known as Central Bank intervention. Any of these factors, as well as large market orders, can cause high volatility in currency prices. However, the size and volume of the Forex market makes it impossible for any one entity to "drive" the market for any length of time.

Fundamental vs. Technical Analysis

Currency traders make decisions using both technical factors and economic fundamentals. Technical traders use charts, trend lines, support and resistance levels, and numerous patterns and mathematical analyses to identify trading opportunities, whereas fundamentalists predict price movements by interpreting a wide variety of economic information, including news, government-issued indicators and reports, and even rumor.

The most dramatic price movements however, occur when unexpected events happen. The event can range from a Central Bank raising domestic interest rates to the outcome of a political election or even an act of war. Nonetheless, more often it is the expectations surrounding an event that drives the market rather than the event itself.

Buying and Selling

In the forex market, currencies are always priced and traded in pairs. You simultaneously buy one currency and sell another, but you can determine which pair of currencies you wish to trade. For example, if you believe the value of the euro is going to increase vis-á-vis the U.S. Dollar, then you would go long on EUR/USD instrument (currency pair). Obviously, the objective of forex currency trading is to exchange one currency for another in the expectation that the market rate or price will change so that the currency you bought has increased its value relative to the one you sold. If you have bought a currency and the price appreciates in value, then you must sell the currency back in order to lock in the profit. An open trade or position is one in which a trader has either bought / sold one currency pair and has not sold / bought back the equivalent amount to effectively close the position.

Market Conventions

Market conventions are rules and standards imposed by a governing body. In case of decentralized forex market these conventions might differ due to many national regulators (FSA, FSC, CFTC, NFA, BCSC, etc.). Since there is no central governing body that sets forex market rules and standards, we will reference only these that are universal.

Quoting Conventions

The first currency in the pair is referred to as the base currency, and the second currency is the counter or quote currency. The U.S Dollar is usually the base currency for quotes, and includes USD/JPY, USD/CHF, and USD/CAD. The exceptions are the Euro (EUR), Great Britain Pound (GBP), and Australian Dollar (AUD). As with all financial products, forex quotes include a "bid" and "ask", which is more often called "offer" in the forex market. The bid is the price at which a forex market maker is willing to buy (and you can sell) the base currency in exchange for the counter currency. The offer is the price at which a forex market maker will sell (and you can buy) the base currency in exchange for the counter currency. The difference between the bid and the offer price is referred to as the spread.